Consumers’ communication preferences couldn’t be more clear. Whether it’s reminders, alerts, or back-and-forth communication, 90% of consumers prefer to interact with businesses through text.

That includes your insurance agency.

But don’t think of SMS as just another communication channel. Text messaging for insurance can transform your business by shortening claim resolution times, streamlining your workflows, and boosting client satisfaction.

In this guide, we’ll review some best practices to ensure your texting efforts are successful. To help you get started, we’ll also provide text templates. Then we’ll expand on the reasons you should use business text messaging services that you can share with your team in case you need buy in at your company.

Let’s get to it.

Why use SMS messaging at your insurance agency

Your digital-savvy competitors have already embraced consumers’ preferred channel. Brian Thomas, director of claims experience at Coterie Insurance, says, “One of the huge things here is that we have to meet customers where they are. So text messaging is key.” Learn more about how Coterie Insurance streamlines claims through texting.

But in case you still need to get buy in on your team to use incorporate text, there are many important reasons you should.

Get better open rates

Average SMS open rates are about 82% vs a 27% open rate for email. So you’re far more likely to get your message across if you use text.

Answer basic questions quickly

Texting is all about efficiency. You can be notified of incoming messages instantly and respond right away, in brief, without the delays associated with email and phone calls.

Streamline repetitive tasks

You can integrate text with existing tools like your CRM or calendar app to streamline communication workflows. For example, you can set up automated texts to confirm receipt of a homeowners claim or to arrange a yearly insurance policy review through your Calendly link. 📆

Adjudicate claims faster

Poor communication or confusion about coverage and protocol can delay the adjudication process. You can resolve customer claims faster by answering questions via text and sending automated messages detailing the status and next steps. You can also minimize costs related to productivity loss, expenses (such as additional rental car days), and more.

Nurture leads

Text communication isn’t just for existing policyholders; it can show prospects you’d be a responsive, engaged partner. Add an SMS link to your website and mobile app to encourage potential leads to reach out or send a text after a prospect completes a web form.

Promote self-service

Some of your customers don’t realize how easy it is to access their policy information themselves. Todd Berg, owner of Spotlight Insurance, uses text as a gentle nudge towards self-service. “Clients will reach out asking for proof of insurance when they’re unprepared at the DMV or on vacation attempting to rent a car. I can respond quickly through a text sharing a link to our portal where they can easily retrieve it themselves, saving time for both of us,” says Todd.

Insurance texting best practices

Just because text open rates are sky high doesn’t mean your efforts will be effective. But if you incorporate some best practices, you can achieve your team’s goals.

1. Play by the rules

Texting can enhance your relationship with your customers and prospects and be an effective revenue channel. But, on the flipside, sending unwanted texts can annoy them and subject your insurance company to hefty fines and penalties (see information about GDPR or TCPA guidelines along with our SMS compliance guide for best practices on texting).

That’s why you must only text those who want to hear from you. You can get the recipient’s permission by giving them ways to opt-in to text messages, such as through your website or online payment portal. Once they’ve given the green light, be sure to include an opt-out message with the initial text to a contact, such as: “To opt out of texts from us, reply STOP.” You can also help prevent your texts from being flagged by your recipient’s carrier by mistake if you include an opt-out sentence with your message if you haven’t texted someone in a long time, but they opted into a specific campaign with your business.

If you send business texts to any US number using a virtual phone solution like OpenPhone, you’ll also need to be registered with The Campaign Registry, a third-party organization selected by the major US cell carriers. This registration requirement for anyone using a local phone number (in other words, non toll-free numbers) helps reduce the amount of spam their customers receive.

To get any OpenPhone workspace registered (if your team hasn’t yet), you can complete the US carrier registration form.

2. Be professional while considering your brand and audience

From Progressive Insurance’s ad campaign “becoming your parents” to Farmers’ recountings of outlandish, real policyholder tales, the insurance industry has largely shed its stuffy, boring image.

SMS supports this shift in overall strategy as a modern, casual form of communication. Still, you must project professionalism and credibility as you introduce SMS to your audience.

Using emojis might be on-brand for one insurance agency, but they may turn off the audience of another. Emojis aside, you should always avoid using industry-specific acronyms, regardless of your target audience. For more suggestions, check out our post about text message etiquette.

3. Leverage contact properties for personalization and better service

The last thing you want is to come across as spammy when you text your prospects and customers. Addressing them by name is the easiest way to combat that reaction and make them more open to insurance SMS interaction.

But you can do better than that by customizing your texts according to the policies they own. For instance, you could tailor a thank you text for a customer that added a young driver to their auto policy by linking to the teen driver safety content on your website. Now that’s a way to show you care.

If you use OpenPhone, you can give your claims teams additional context to provide better customer service. For example, Coterie Insurance includes the following within each profile using custom contact properties:

- Name

- Phone number

- Email address

- Claim number

That way, if someone reaches out to Coterie Insurance, their team members can provide excellent customer service without delay because they already have their claim number handy.

4. Enable auto-replies on missed calls

Purchasing insurance can be complex — 78% of consumers call an agency after conducting a Google search. With so many to choose from, a missed phone call can be a missed opportunity. Enabling text auto-replies will show your potential and existing customers you care about their call.

Be sure to set them up to automatically reply also outside of your business hours as a way to set expectations on when someone can expect to hear back from your team.

5. Text from your main office number

No readily available research breaks down SMS open and response rates by known and unknown senders. But it’s reasonable to assume that some people ignore texts from unknown numbers. That’s why it’s important to text from the number they’re most likely to recognize or save to their contacts: your main office number.

Using OpenPhone, you can easily call and text from any computer, smartphone, or tablet so that no one on your team is communicating with customers using their personal cell numbers.

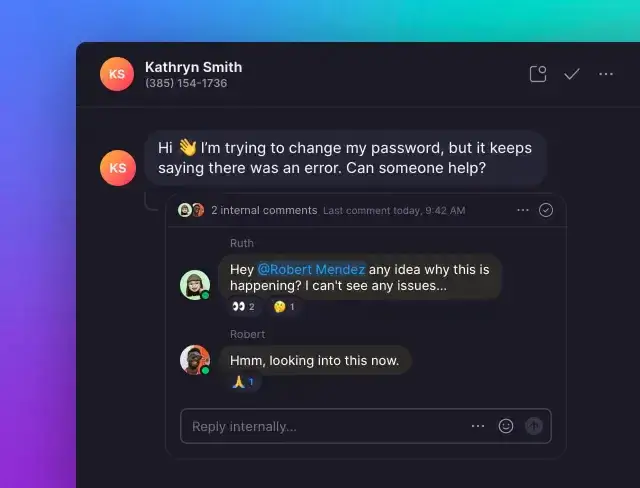

Your team can use your main office number as a shared number to divide and conquer responsibilities related to incoming messages. In the above conversation, you can also see teammates commenting internally on a text thread — these comments are only visible internally so you can assign tasks and work together.

6. Mute notifications when you’re off

Standard business hours are a thing of the past — especially as more people embrace text to conduct their personal business. Of course, that’s not a problem if your claims department has extended business hours. But as an insurance agent, you probably like having your evenings and weekends off.

To maintain that all-important work-life balance, mute notifications after hours (and set an auto-reply explaining when you’ll call back).

7. Save go-to messages as snippets

You can waste a lot of time recreating or copying and pasting the same responses to prospects’ and customers’ texts. With OpenPhone, you can save your go-to messages as snippets so you can respond faster and save your energy for more mission-critical tasks.

Just type “/snippets” into the text box and choose the applicable message, whether it’s an answer to frequently asked questions (FAQS) or a follow-up message after a new policy purchase.

Of course, you can automate text snippets, such as a birthday greeting or upcoming policy renewal reminders. Using OpenPhone, you can schedule a text for a customer’s birthday or seven days before a policy renewal fee is due (as noted in a custom contact property).

Insurance texting templates

Modern consumer expectations and communication preferences are pretty clear — they want to be able to text with businesses. So whether you sell life insurance, health insurance, auto, or homeowners, it’s time to embrace text.

Here are some texting templates you can use to guide your one-on-one interactions or automated texts. In addition, we included an example of SMS automation using OpenPhone and Zapier workflows.

Again, remember to include an opt-out with every message, like: “To stop receiving texts, reply STOP.”

1. Website form follow-up

Some prospects will call your agency directly, while others will fill out a form on your website to get an insurance quote. Here’s how to respond and qualify online inquiries with a text.

Example: Hi [name]. My name is [agent name] from [insurance agency]. We’ve received your request for a quote. Can we discuss your coverage needs in more detail so I can put together an accurate, competitive quote? Please choose a time that works for you: [Calendly link]. If you prefer to no longer receive messages, reply STOP.

Copy to Clipboard

2. Claim status

Texting is an easy way to stay connected with your customer throughout their claims process and proactively share status and next steps. You can easily automate your updates if your customers can initiate a claim through a mobile app. 📱

Example: Hi [name]. It’s [agent name] from [insurance agency]. We’ve received your claim, and it’s in review. We will provide an update in 1-2 business days. Until then, you can access more information through [agency portal]. To opt out of messages, reply STOP.

Copy to Clipboard

3. Policy review request

Some insurance companies sell you a policy, and that’s the last you hear from them (unless you reach out directly). It’s not difficult to provide better service when it’s time for a customer to renew their policy, especially if you use SMS.

Example: Hi [name]. It’s [agent name] from [insurance agency]. Thanks for your continued business. You’re approaching your policy anniversary. Before you renew, I wanted to ensure you have the right coverage and that you receive any additional discounts you qualify for. Pick a time that works for you [Calendly link]. To stop receiving texts, reply STOP.

Copy to Clipboard

4. Appointment reminder

Once you’ve scheduled a meeting with a prospect or client, sending a reminder text will help reduce no-shows.

Example: Hi [name]. It’s [agent name] from [insurance agency]. I’m looking forward to our scheduled meeting at [date and time]. If your availability has changed, just access my [Calendly link] to reschedule. To opt out of receiving any messages from us, reply STOP.

Copy to Clipboard

You can automate these appointment reminder texts through OpenPhone using our Zapier integration.

If you have a standard Zapier plan, you can use Zap delays to put the action on hold for a specific amount of time.

For instance, here’s how to schedule a reminder text 55 minutes before a meeting booked in Calendly:

Keep in mind you’ll need a Professional plan or higher plan with Calendly to use this Zap workflow.

5. Follow up after a meeting

Looking to reaffirm the next steps or keep the customer journey moving along? Texting allows you to reach your prospect or customer while things are still fresh in their minds.

Example: Hi [name]. It’s [agent name] from [insurance agency]. Thanks again for meeting with me to discuss a [policy type]. I’ll get you that quote tomorrow morning. In the meantime, you can learn more about coverage and our company here: [agency webpage]. If you wish to no longer receive texts from us, reply STOP.

Copy to Clipboard

6. Payment reminder

Payment due dates can slip by even the most organized among us — whether we get our bills electronically or the old-fashioned way. 📪 Unfortunately, email payment reminders can be easily overlooked, but a text? Not as much.

Example: Hi [name]. The renewal date for your [policy type] policy with [insurance agency] is approaching. Be sure to renew before [renewal date] to maintain your coverage. Pay by ACH or credit card here: [agency portal]. To stop receiving texts, reply STOP.

Copy to Clipboard

7. Ask for a review

When you’re in the insurance business, there’s nothing better than direct referrals. But positive customer reviews on your social media channels are a close second. Text is a great way to ask for them.

Example: Hi [name]. It’s [agent name] from [insurance agency]. I wanted to thank you for entrusting us with your business. I have a favor. If you’re satisfied with our service, can you please leave a review? It would just take a moment or two: [link]. To opt out of receiving messages from us, reply STOP.

Copy to Clipboard

Start sending insurance text messages today

The insurance industry is highly competitive and being able to differentiate yourself is key to staying in the game.

And when interactions don’t require a phone call or email, you must be able to text.

Try OpenPhone free for seven days to see how it can support your text messaging for insurance strategy.