There are many ways to connect with your clients, but their preferences are clear: 90% want to interact with businesses through text.

Though you can’t conduct all aspects of your business by texting back and forth, there are key applications for finance SMS that will save you time, streamline your workflows, and enhance your customer relationships.

Whether you’re a financial planner, a CPA, or an investment advisor, this guide will explain why and how to incorporate texting into your communication with clients. We’ll also share 11 real-world examples you can use as text templates for inspiration.

Let’s go.

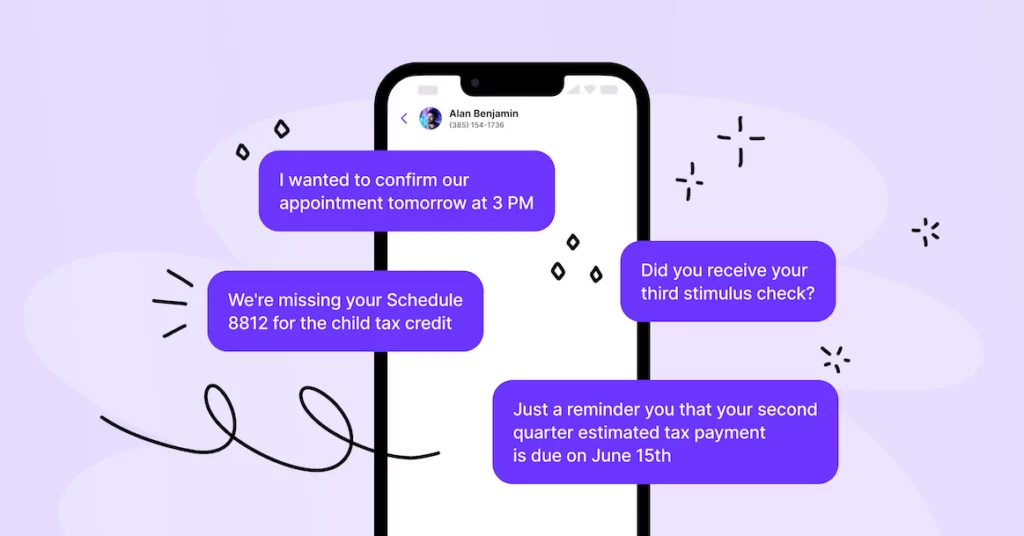

11 Text messaging examples for finance professionals

A quick text message can save time, eliminating the need to have a conversation over the phone, leave a voicemail, or craft an email. Here are 11 instances you can use text instead, along with some finance SMS templates you can make your own.

Be sure to follow compliance rules for SMS messages and include an opt-out message with every text you send, such as: “To stop receiving texts, reply STOP.”

1. Appointment invite

Eliminate the waiting period and back and forth associated with setting appointments over the phone or via email. Instead, sending an appointment invite in a text (with a link to your calendar) is far more efficient.

Example: Hi [name]. [Financial business name] would like to welcome you back for another tax season. As you know, our virtual and in-person appointments fill quickly. You can call [local office number] or visit [website link] to schedule an appointment. Reply STOP to opt out of future messages.

Copy to Clipboard

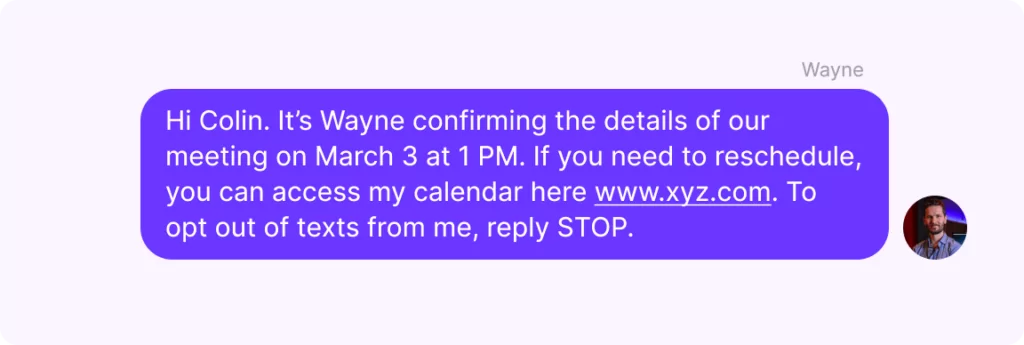

2. Appointment confirmation

Missed appointments can be costly for a busy financial services professional, disrupting your daily schedule and workflow. Texting allows you to confirm appointment details immediately, an essential first step to reducing no-shows.

Example: Hi [name]. It’s [your name] confirming the details of our meeting on [date and time]. If you need to reschedule, you can access my calendar here [Calendly link]. To opt out of texts from me, reply STOP.

Copy to Clipboard

You can use Zapier’s OpenPhone + Calendly integration to trigger a Zap to send a text through OpenPhone after a client books an appointment in Calendly.

3. Appointment reminders

Sending a text reminder for an upcoming appointment can make no-shows even less likely.

Example: Hi [name]. It’s [your name] from [firm name]. I wanted to confirm our appointment tomorrow at [time]. If your availability has changed, you can pick a time to reschedule here [Calendly link]. To stop receiving texts, reply STOP.

Copy to Clipboard

One study found that you can reduce no-shows by 29% by sending automated appointment reminders. Zap delays can help with automation, allowing you to send appointment reminder texts based on a specific time interval (as long as you have at least a Starter Zapier plan).

4. Post-meeting follow up

You can use text to review and remind clients of action items you discussed during your meeting, such as a document request.

Example: Hi [name]. It’s [your name]. Thanks for your time today. As we discussed, please text or email [document name] to me at your earliest convenience. Let me know if you have any questions. To opt out of receiving texts, reply STOP.

Copy to Clipboard

5. Follow up on a missing document

A missing document can put an entire process or workflow on hold. Sending a follow-up text is the quickest way to communicate an urgent request.

Example: Hi [name]. It’s [your name]. We are missing your [form] for the [state tax credit]. Please upload it to [client portal link] to avoid filing delays. If you don’t want to receive texts from us, please respond STOP.

Copy to Clipboard

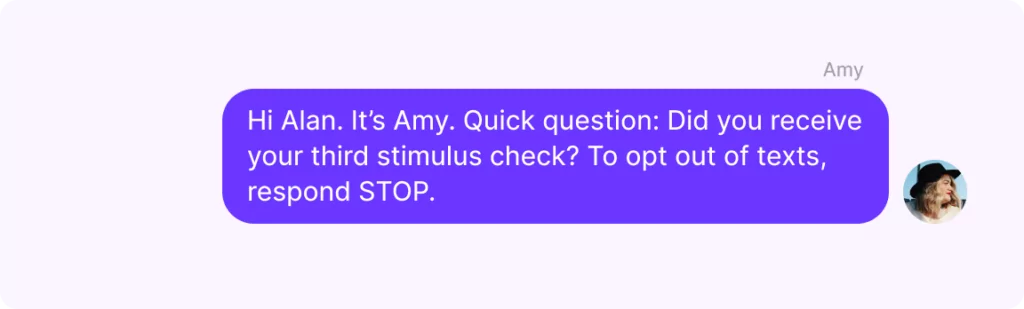

6. Quick questions

Sarah York of Keeper Tax considers texting a huge time saver, especially when she’s up against a tax deadline. “Rather than interrupting my client’s day with a phone call or risking my email getting lost in their inbox, I use text to ask general questions like, ‘Hey, what was your business mileage last year?’ It really speeds up the process.”

Example: Hi [name]. It’s [your name]. Quick question: Did you receive your third stimulus check? To opt out of texts, respond STOP.

Copy to Clipboard

7. Tax filing deadline notifications

While April 15th is ingrained in most CPA’s minds as the traditional filing deadline for annual returns, you can use text to send notifications about other important dates.

Example: Hi [name]. It’s [your name], reminding you that your second quarter estimated tax payment is due on June 15th. You can find your payment voucher and instructions by accessing [client portal link]. To opt out of texts from me, reply STOP.

Copy to Clipboard

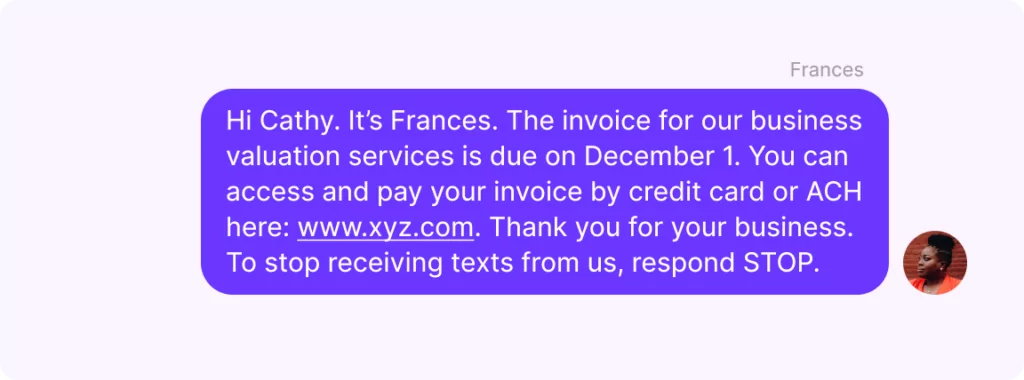

8. Invoice due reminder

Invoices can get lost in a busy email inbox or a stack of papers. Sending a payment reminder via text to ensure you get paid on time is a win-win for you and your client.

Example: Hi [name]. It’s [your name]. The invoice for our business valuation services is due on [date]. You can access and pay your invoice by credit card or ACH here: [link]. Thank you for your business. To stop receiving texts from us, respond STOP.

Copy to Clipboard

9. Request for feedback

Customer satisfaction has always been important, but it’s even more crucial today, given the social landscape and our collective obsession with reviewing everything.

And as a finance professional, you depend on word of mouth and referrals to fuel your business. That’s why you should ask for feedback so you can proactively address any ways you fall short.

Example: Hi [name]. It’s [your name]. I strive to meet my clients’ expectations, and I wanted to ensure I’m meeting or exceeding yours. I’m always open to feedback. Feel free to share any thoughts by text, [email link], or call me directly at [phone number]. I appreciate your trust and look forward to helping you reach your retirement goals. To opt out of text messages, respond STOP.

Copy to Clipboard

10. Company policy change

Sending a quick text can ensure your clients are aware of policy changes or updates they may have overlooked via email or regular mail.

Example: Hi [name]. It’s [your name]. I wanted to make sure you’re aware that our terms and conditions for our [service name] are changing on [date]. We sent this information via your preferred communication channel, but you can also review the changes here: [link]. Feel free to give me a call if you have any questions. To stop receiving texts, respond STOP.

Copy to Clipboard

11. Client check-in

Depending on your area of expertise, your clients could be entrusting you with their livelihoods. So it’s understandable if the changing economic landscape causes concern or distress.

Paul Sundin, CPA and tax strategist with Emparion, uses text to put his clients at ease. “With the current situation, some of my clients worry about the effect on their retirement savings. As much as possible, I want to ease their worries. So I’ll send a simple text that explains the changes in the economy, how they will affect their plans, and the action plan I have for them. I reach out individually as they all have unique plans and situations.”

Example: Hi [name]. It’s [your name]. I understand the recent announcements about interest rates may be concerning to you. I believe our [XYZ] approach has positioned you to emerge from this period of uncertainty with your retirement goals intact. If you have any questions, I am happy to set up a meeting. To stop receiving texts from me, reply STOP.

Copy to Clipboard

Best practices for SMS in financial services

In addition to GDPR or TCPA guidelines on texting, the financial industry must abide by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC) regulations. So it’s understandable if you’ve avoided (or your firm has a policy against) texting clients.

But if your company’s on board with providing a better customer experience, here are some best practices for texting your clients.

1. Ensure clients opt into texting (and have a way to opt out)

Tell your existing clients to sign up to receive texts as an additional, more efficient communication method for appointment scheduling, confirmations, document requests, invoice reminders, etc. You can offer subscriber opt-in links through your website, client portal, or email signature.

Again, even if you obtain permission to send SMS, you must include an opt-out message (“To opt out of texts from us, reply STOP.”) with the initial text you send a professional contact even if they opted in. It’s also generally a best practice to include similar messaging when you haven’t texted someone in a long time.

2. Register with The Campaign Registry

The large US cell carriers now require anyone texting from a virtual phone solution to register with The Campaign Registry, a third-party organization handpicked by them. These new guidelines help improve your text deliverability and aim to reduce the overall amount of text spam that occurs. If you’re using OpenPhone and have a local phone number, you can get registered through our US carrier registration form.

3. Text from your main office number

Your clients’ text message inboxes may be crowded with spam, causing them to overlook important messages. That’s why you should text from the number they’re most likely to recognize: your main office number.

In addition, if they decide to call the number you texted from and your company has a phone menu, they can be easily routed to the appropriate person or department.

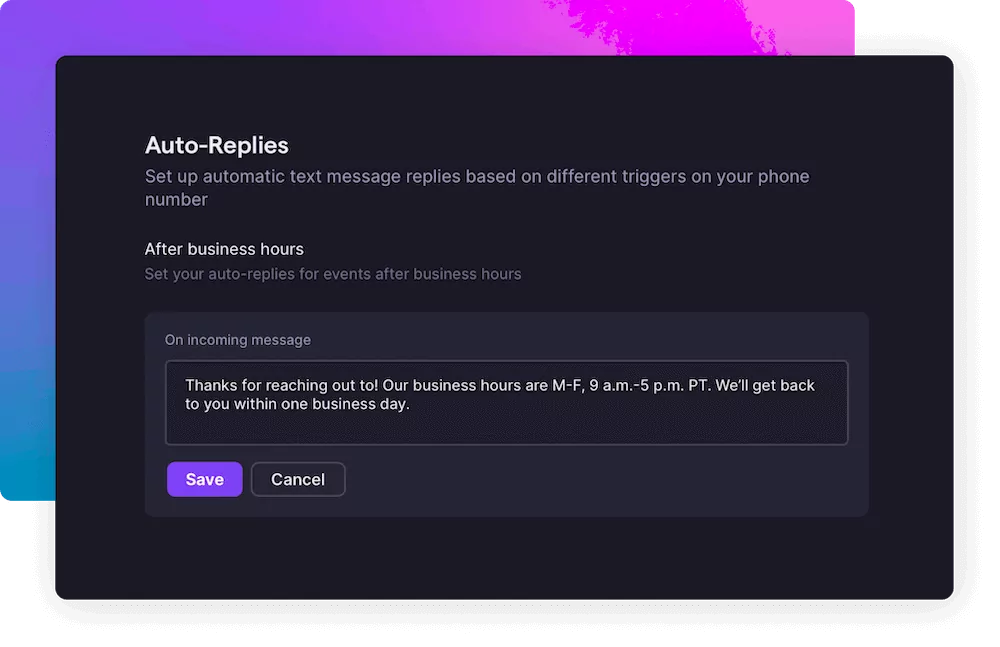

4. Use auto-replies to set expectations

Customer service is key to competing in the financial services industry, but that doesn’t mean you must be available 24/7. Use text auto-replies to immediately respond to prospective and current clients while setting expectations for when they can expect to hear back from you.

OnCentive is acutely aware of the common misconception about web-based service providers: that you’re always “open.” President Chris Wright explains, “We had clients calling people at nine o’clock at night or four o’clock in the morning just to ask questions.” Deploying OpenPhone across their teams allowed them to consolidate communication and easily leverage functionality like auto-replies. “Simple things that are very intuitive that you’d think would be readily available but just aren’t as easy to implement as they should be — but they are with OpenPhone.”

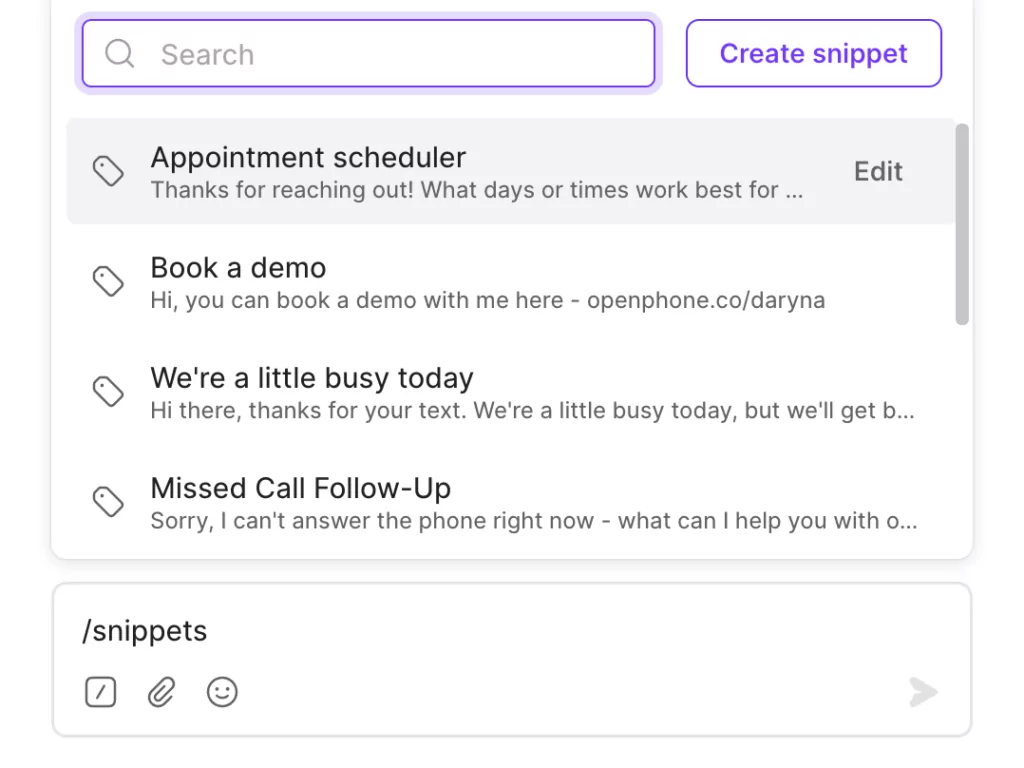

5. Save snippets

You don’t need to type or copy and paste similar responses again and again when you text your clients. You can use OpenPhone to save standard finance SMS messages as snippets instead.

Simply type “/snippets” into the text box and choose the saved snippet you want, whether it’s an answer to a frequently asked question or a standard follow-up with a client.

6. Tag teammates on action items

OpenPhone lets you centralize all communication with clients, making it easy to collaborate and delegate tasks to other teammates. For instance, you can use the @mention feature to tag a teammate to prepare a welcome packet for a new client.

7. Avoid abbreviations and industry-specific acronyms

While SMS is supposed to be brief and to the point, your texts should be professional and written in terms the average person can understand. So try to avoid using abbreviations, slang, or industry jargon that might detract from your message.

Why you should use finance SMS

The importance of being able to communicate quickly and efficiently with your clients can’t be overstated, regardless of your industry or area of expertise. Here’s how incorporating finance SMS can facilitate excellent communication and your client service goals.

- Clients are more likely to respond: Email isn’t the most effective way to reach people — the same is true for calling and voicemail. Text messaging has a much better response rate given the average person opens and replies to 95% of text messages within three minutes (versus a 20% open rate for emails).

- Text saves time and resolves issues quickly: With text, you can answer simple questions, provide customer support, and begin to address client issues in near real time.

- SMS supports smooth workflows: Text helps you stay on top of important milestones and keeps processes flowing. For instance, you can integrate SMS with your existing tech stack (like your CRM or calendar app) to automate specific repetitive tasks like setting up yearly reviews with your clients.

- Texting can build strong relationships: Text is a great way to stay connected and provide value. For instance, you can share links to useful content like retirement planning tips, articles from financial industry thought leaders, tax savings recommendations, explanations of the impact of new laws, and more. When it comes to client relationships, each of these can help create an emotional deposit.

Ready to roll out finance texting?

Given the intricacies of the financial industry, there are times you must pick up the phone, send an email, or use USPS to conduct business. Unfortunately, these communication channels can cause delays that can impact the level of service — even the results — you provide to your clients. Professionals who use text can eliminate crucial communication delays.

Try OpenPhone free for a week to see how it can support finance SMS for your business.