Clients don’t always stay on top of their payments. When life gets busy and inboxes fill up, your invoices may slip their minds or fall behind on their list of priorities.

However, a payment reminder message (or a few) is often all it takes to get your clients back on track. Here’s how you can craft effective email and text message reminders, along with best practices you need to know.

Payment reminder text message templates

When you need to send timely messages to your customers, text messaging can be the most effective choice. With far higher open rates than email, it adds urgency to your payment message and gets your message across fast. A microloan study found that SMS messages can improve repayment rates by 7-9%. 🙌

Payment reminder texts can follow many of the recommendations for email, like getting firmer and more direct over time. However, you should keep the details brief and under 160 characters max to avoid text message delivery issues.

To do so, direct clients to helpful links (like online payment portals) using a shortened URL when possible.

Here are four text message payment reminder examples you can use for your business.

💡 If you manage a property, check out our rent reminder templates guide.

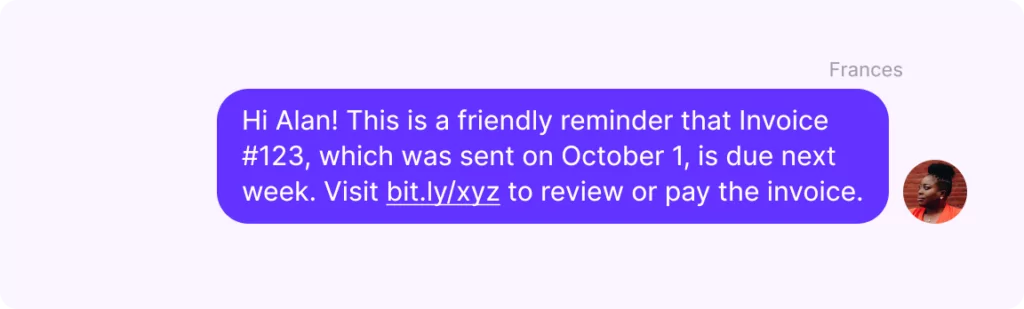

1. Friendly payment reminder example

Hi [Client Name]! This is a friendly reminder that Invoice [#], which was sent on [Date], is due next week. Visit [URL] to review or pay the invoice.

Copy to Clipboard

2. Due date payment reminder message

Hi [Client Name]! Your payment for Invoice [#] is due today. You can pay by credit card or eCheck at [URL]. Please respond with any questions.

Copy to Clipboard

3. Late payment reminder message

Hi [Client Name]. Your payment of [$ amount] for Invoice [#] is overdue by one week. Please review the invoice and submit a payment at [URL].

Copy to Clipboard

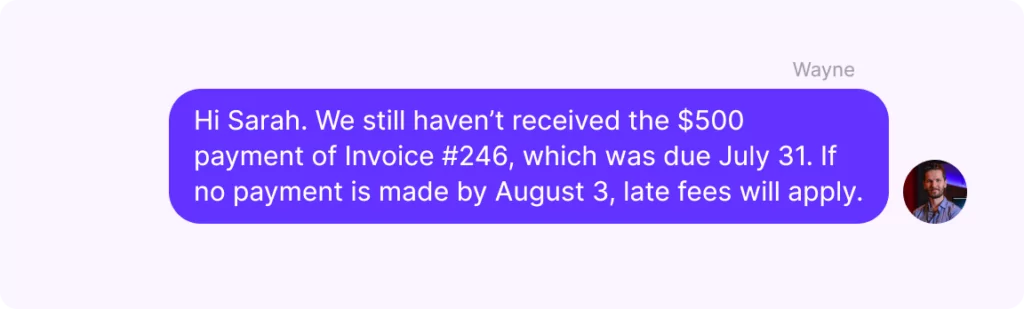

4. Late payment follow-up reminder message

Hi [Client Name]. We still haven’t received the [$ amount] payment of Invoice [#], which was due [Date]. If no payment is made by [Date], late fees will apply.

Copy to Clipboard

Payment reminder email templates

Nearly half of all invoices in the US become overdue, which means follow-ups are often a necessity. Using email, you can add context to your reminders — whether it’s the original invoice or a complete list of available payment methods — to encourage your clients to start the payment process. Here are four effective payment reminder email templates you can use.

1. Friendly payment reminder email for upcoming amount owed

The first email you send should be a friendly, gentle nudge. While the payment due date is approaching, your client isn’t at risk for an overdue invoice yet.

Example

Subject line: Reminder: Upcoming payment due date

Copy to Clipboard

Body:

Hi [Client Name],

Hope all is well. This is a friendly reminder that Invoice [#] is due next week on [Date].

When you get the chance, please review the invoice, which was sent on [Date]. We’ve attached a copy of the invoice for your convenience. Feel free to respond to this email with any questions.

Thank you,

[Company name or sender name]

Copy to Clipboard

2. Due date payment reminder email

On the due date of your invoice, it’s important to take a firm but friendly tone in your follow-up email. Get to the point and state your payment methods to help your client complete their payment on time.

Example

Subject line: Invoice [#] is due today

Copy to Clipboard

Body:

Hi [Client Name],

This is a reminder that your payment for Invoice [#], which was sent on [Date], is due today. You can pay by credit card or eCheck through the payment link on the invoice.

If you have any questions or need help with your invoice payment, please don’t hesitate to reach out by replying to this email.

Thank you,

[Company name or sender name]

Copy to Clipboard

3. Late payment reminder email

Your first overdue payment reminder message should be firmer than your previous ones and clarify payment details, like the total due and the date payment was due. Be professional and avoid taking an accusatory tone by avoiding “you” statements (like “you haven’t paid”) that point the blame.

Example

Subject line: Invoice [#] is one week overdue

Copy to Clipboard

Body:

Hi [Client Name],

Our records show that the [$ amount] payment of Invoice [#] is past due by one week. Please review the invoice, which was originally sent on [Date]. We’ve attached a copy of the invoice for your convenience.

If you’ve already sent payment, please disregard this notice. Please respond with any questions or for help with the payment process.

Thank you,

[Company name or sender name]

Copy to Clipboard

4. Follow-up late payment reminder email

Still haven’t received a payment? Be firm and direct about the unpaid invoice and payment terms. Reiterate that the invoice has been due and clarify if any late payment fees will start to apply. Directly asking for a response is a good way to get your client to take action, even if it’s just to reach out for payment assistance.

Example

Subject line: Invoice [#] is two weeks overdue

Copy to Clipboard

Body:

Hi [Client Name],

This is our fourth communication regarding the [$ amount] payment of Invoice [#], which was originally sent on [Date] and due two weeks ago. If this invoice remains unpaid on [Date], a late fee of [percentage %] ($ amount) will apply.

For your convenience, a copy of the outstanding invoice is attached. We’re here to answer any questions regarding the payment. Please respond to this email to confirm that you’ve received the invoice and this reminder.

Thank you,

[Company name or sender name]

Copy to Clipboard

Best practices for sending payment reminder messages

Whether you’re sending a payment reminder message over email, text, or both, you don’t want to show your frustration or risk damaging a customer relationship. These simple best practices can help you craft and send better follow-ups:

- Avoid using link shorteners for URLs in texts. The recipient’s carrier may filter out Bit.ly and other link-shortening services due to emerging regulation policies.

- Help clients access their invoices. If clients have to search for your invoice, they’re not as likely to pay. Help them out by reattaching their invoice or providing a direct link to it.

- Include an invoice number in every message. You can avoid unnecessary back-and-forth by giving your client a reference number, so there’s no question of what overdue payment you’re referring to in your message.

- State important dates. Deadlines can spark your clients into action. Make sure they know when a payment is (or was) due and clarify when penalties begin.

- Be clear and concise. While it’s important to be polite, especially on your first two follow-ups, avoid beating around the bush to make sure your message is clear.

- Don’t overwhelm your customers. It may be tempting to send endless follow-ups, especially if you’re a small business owner who relies heavily on each invoice to pay bills. However, daily messages can be irritating, especially if your client was planning on making a timely payment in the first place. You want your customers to come back, not to push them away.

- Help prevent your outbound texts from being filtered. The large US cell carriers now require any sending business texts to anyone in the US using a virtual phone solution such as OpenPhone to submit their business profile to The Campaign Registry. This third-party agency selected by the major US cell carriers reviews the business information you supply to them.

If you have a local business number (non-toll free) through OpenPhone, you must complete the US carrier registration form (if you haven’t done so already). When you register, be sure to include any specific examples of texts you plan to send from your OpenPhone number.

When should you send a payment reminder message?

You can send payment reminder messages at set intervals until you receive a payment. Weekly reminders work well for many businesses since they’re not too pushy or too sparse.

No matter what time intervals you choose, it’s best to prepare invoice reminders to send before, on, and after the payment due date. Using our payment reminder message templates, you can follow up with each of your clients using:

- An advanced payment reminder the week before the due date

- A due date payment reminder on the due date

- A late payment reminder a week after the due date

- A follow-up late payment reminder two weeks after the due date

You can choose to send more follow-up messages for outstanding payments. However, every company needs to have set payment terms for enforcing penalties, like late fees or sending invoices to collection agencies. No business owner wants to get stuck in an endless loop of follow-up emails or text messages.

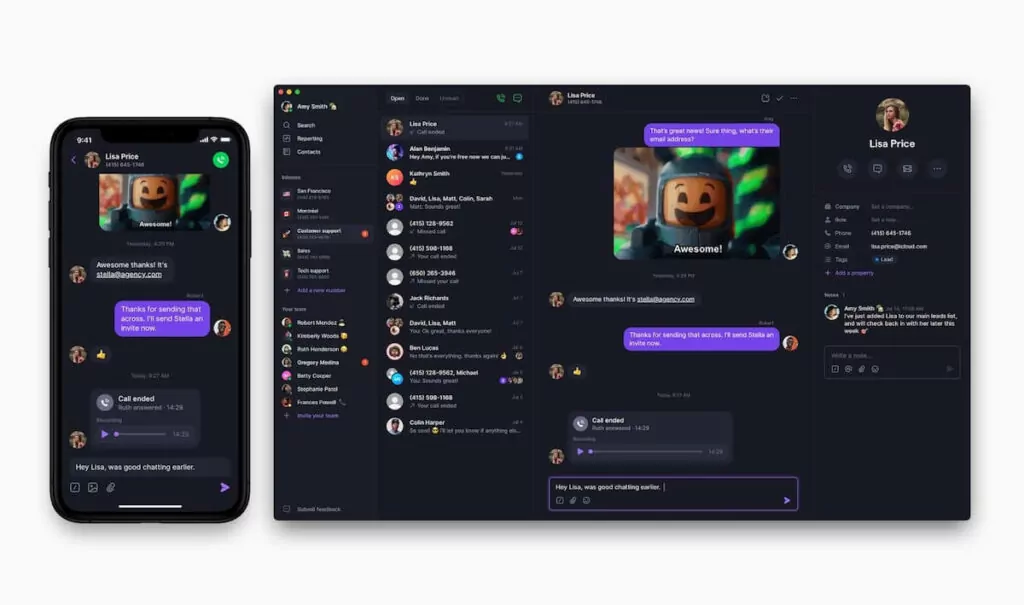

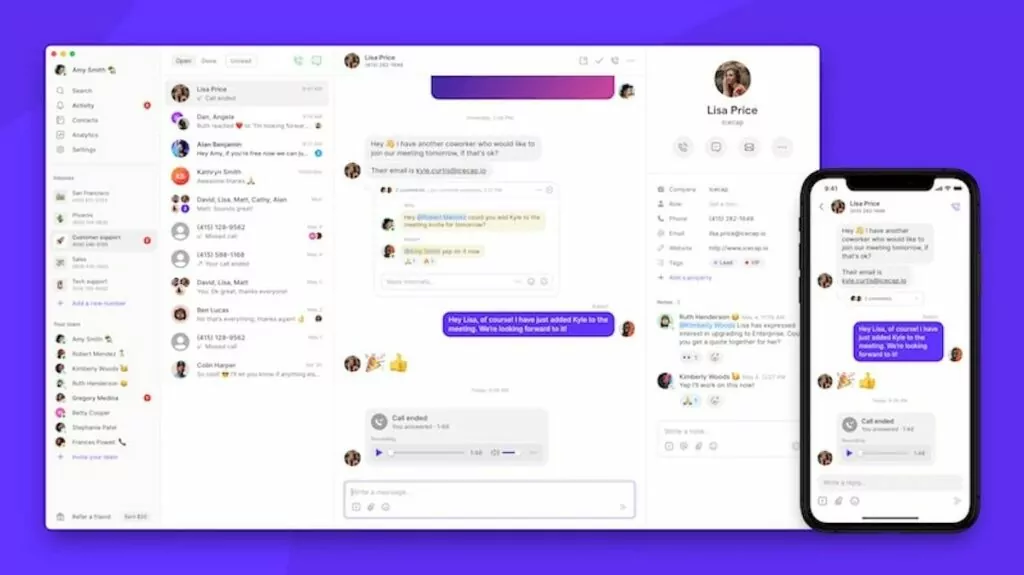

How to send payment reminder messages in OpenPhone

Sending payment reminder messages through text doesn’t have to be time-consuming. With a VoIP app like OpenPhone, you can streamline your SMS reminders in two ways.

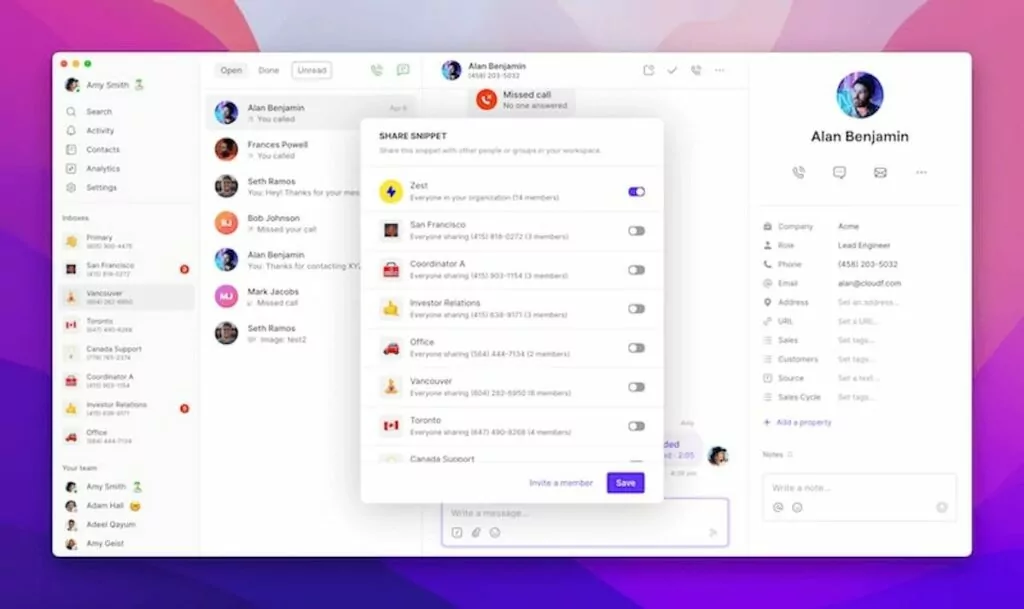

Schedule and send customized snippets

When you make a snippet on OpenPhone, sending a reminder or follow-up text is as easy as tapping on a pre-saved text message template and customizing it with your customer’s invoice details. Hop on your OpenPhone account (from the web or desktop app) and follow these steps to create a snippet:

1. Type “/snippets” into the message box of any text message thread, then press enter.

2. Select “+ Create snippet.”

3. Name your snippet and type out the text message template you want to use and save.

4. Click “Share” to share your snippet with users or other numbers on your account.

5. Click “Save” and your snippet is ready to use.

Once you have your payment reminder snippets, you can schedule payment reminder texts in OpenPhone. Here’s how:

1. Type “/snippets” and select the snippet you wish to send.

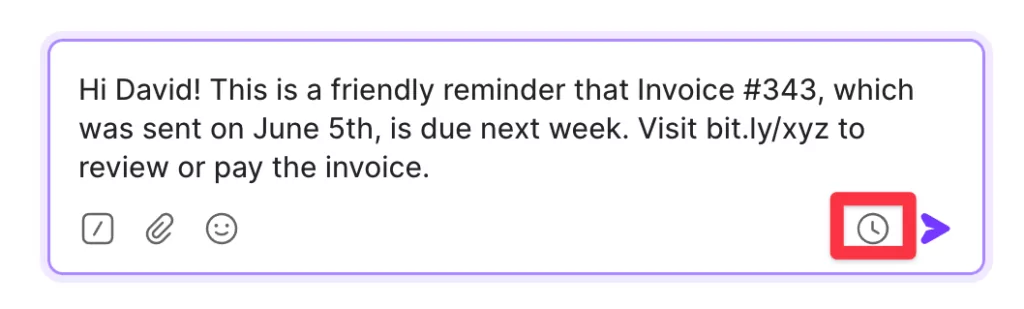

2. After you’ve tweaked your drafted message, click the clock icon.

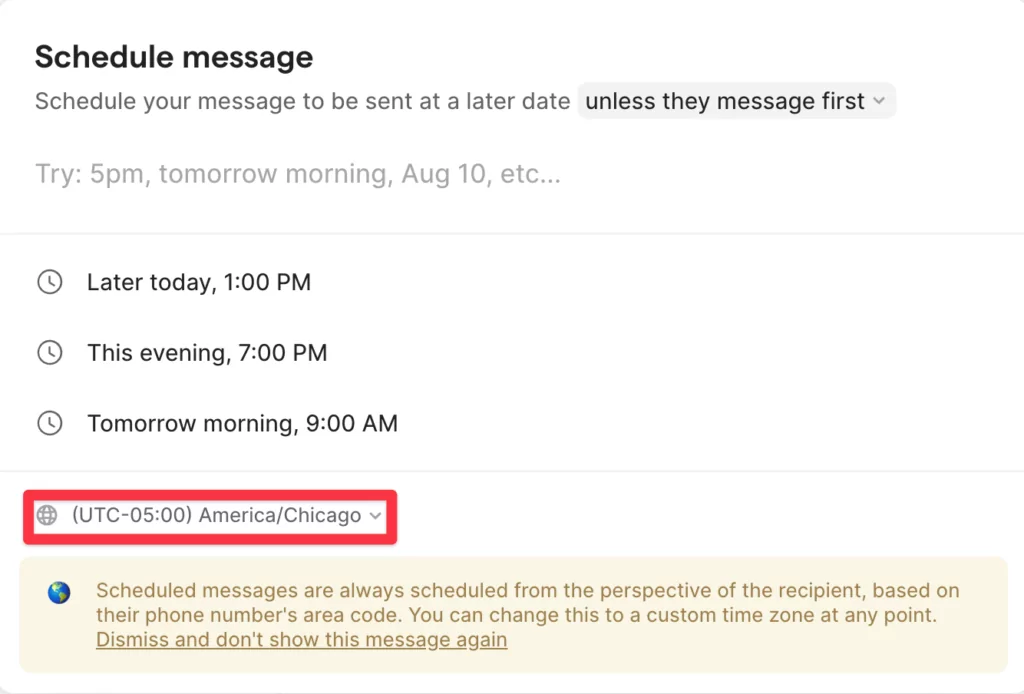

3. Scheduled messages estimate your recipient’s time zone based on their phone number’s area code. You can change this to a different time zone from the drop-down menu.

4. Specify the date and time you wish your payment reminder message to go out.

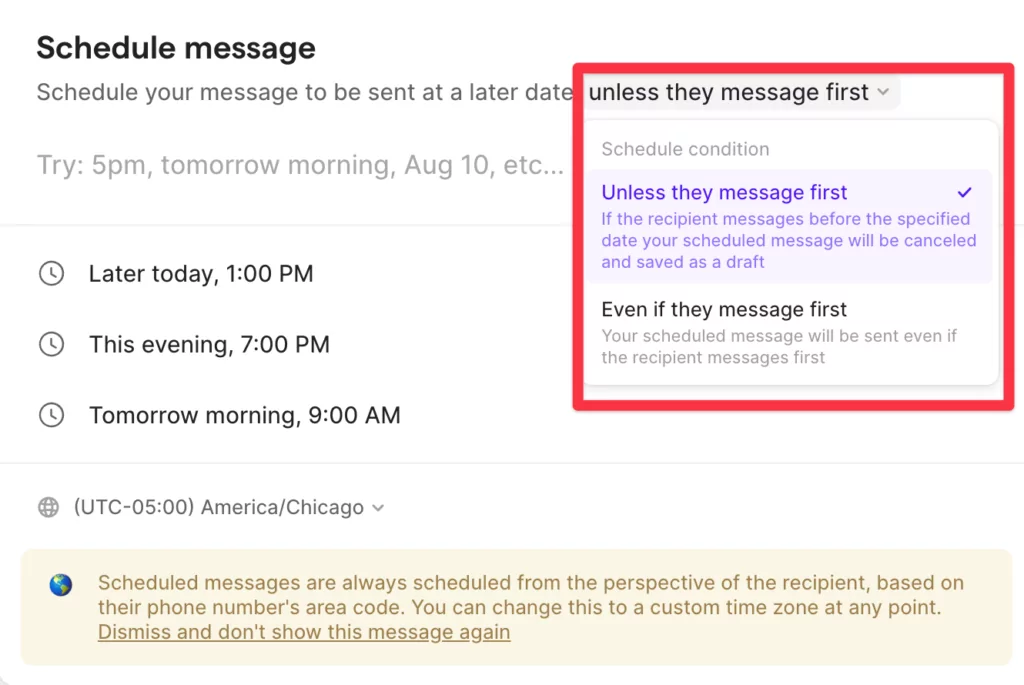

By default, if your intended recipient messages you before your scheduled message goes out, your scheduled message won’t go out to help you avoid awkward conversations.

Instead, the message will be canceled and saved as a draft. You can update this setting to “even if they message first” if you wish for your message to go out regardless of whether the recipient messages you first.

Automate your payment reminder messages

Want to make your payment reminder messages hands-free? You can send automatic payment reminder messages with the OpenPhone Zapier integration. You can use the Zapier integration to trigger a text message when a contact property in your customer relationship management software (CRM) changes, indicating an upcoming or overdue payment.

If you’re an owner or admin user on OpenPhone, you can set up the Zapier integration in five steps.

- Log into your Zapier account or create a new account.

- Navigate to “My Apps” from the top menu bar.

- Click on “Add connection.”

- Search for OpenPhone.

- Use your credentials to connect your OpenPhone account to Zapier.

If you’re using HubSpot as your CRM, you can trigger an automated text by changing a specified contact property field in HubSpot:

Simplify and modernize your payment reminder messages with OpenPhone

If you want to reach your customers faster and get more timely payments, SMS reminders can help.

With OpenPhone, you can speed up and simplify the process of following up with your clients by using our modern text message features. Whether you’re creating snippets or automating texts, OpenPhone can help you save time. Start your free trial of OpenPhone.